世界經(jīng)濟(jì)似乎正處在一個(gè)岔路口,。走其中一條路,,意味著2016年世界經(jīng)濟(jì)狀況可能要從平庸惡化為極糟;而走另一條,,意味著自2008-09年金融危機(jī)以來的正?;M(jìn)程將幸運(yùn)地延續(xù)下去,全球經(jīng)濟(jì)將變得更平衡、更具可持續(xù)性,。沒人能確定世界將走哪條路,;也沒人知道政策力度是否大到足以影響結(jié)果。

毫無疑問,,全世界銳利的目光都聚焦在這些風(fēng)險(xiǎn)和挑戰(zhàn)上,。恐懼在今夏人民幣貶值后急劇上升,,突顯出人們對(duì)中國經(jīng)濟(jì)前景正迅速惡化以及其他昔日全球經(jīng)濟(jì)明星國家(如巴西,、俄羅斯)衰退加深的擔(dān)憂。全球股市剛剛經(jīng)歷了自2011年以來表現(xiàn)最糟的一個(gè)季度,。

伴隨金融市場(chǎng)的疲弱,,資本回撤到了位于發(fā)達(dá)世界的“避險(xiǎn)港”,大宗商品價(jià)格一落千丈,,世界貿(mào)易增長仍停滯不前,。由于中國占全球產(chǎn)出的16%、占全球預(yù)期增長的近3 0%,,不久前還是世界經(jīng)濟(jì)可靠引擎的中國,,如今被視為世界經(jīng)濟(jì)最大的薄弱之處。經(jīng)合組織(OECD)稱:“全球增長的主要風(fēng)險(xiǎn)在于中國超出預(yù)期的增長放緩,。”

在花旗(Citi)等投資銀行預(yù)測(cè)2016年出現(xiàn)全球經(jīng)濟(jì)衰退之際,,各國官員積極希望避免像2008年衰退到來之前那樣被打個(gè)措手不及。

國際貨幣基金組織(IMF)總裁克里斯蒂娜拉加德(Christine Lagarde)表示,,由于“經(jīng)濟(jì)前景下行的風(fēng)險(xiǎn)已經(jīng)增加——尤其是對(duì)于新興市場(chǎng)經(jīng)濟(jì)體而言”,,在此般“困難且復(fù)雜”的時(shí)刻,世界主要經(jīng)濟(jì)體亟需對(duì)策來應(yīng)對(duì)問題,。

英國央行(Bank of England)首席經(jīng)濟(jì)學(xué)家安迪霍爾丹(Andy Haldane)警告稱,,中國遭遇的麻煩表明“我們現(xiàn)在或許正在進(jìn)入(全球危機(jī))三部曲第三部分(即2015年起的‘新興市場(chǎng)’危機(jī))的初始階段”。

繼2008-09年美英經(jīng)濟(jì)體金融危機(jī)以及2011-12年歐元區(qū)危機(jī)后發(fā)生第三場(chǎng)危機(jī),,這種情景將源于2008年以來中國債務(wù)暴漲帶來的危險(xiǎn),。在家庭、企業(yè)勒緊腰帶之前,,2007年美國私人非金融債務(wù)達(dá)到了國內(nèi)生產(chǎn)總值(GDP)的160%,,英國的這一比例接近200%。根據(jù)國際清算銀行(BIS)的數(shù)據(jù),,中國早已超過了上述兩國的水平,。

隨著增長放緩(放緩速度也許遠(yuǎn)比中國官方統(tǒng)計(jì)數(shù)據(jù)顯示的更快),償付并維持這些債務(wù)的能力便成了問題,。違約及巨額損失可能隨之而來,,引發(fā)金融部門脆弱性與破產(chǎn)的惡性循環(huán),,并導(dǎo)致信貸收緊,經(jīng)濟(jì)前景更加黯淡,。鑒于中國經(jīng)濟(jì)的規(guī)模,、它與其他國家的貿(mào)易及金融聯(lián)系,世界其他國家可能無法忽視這樣一場(chǎng)危機(jī),。

北京方面發(fā)出的含混不清的訊息以及今夏阻止股市泡沫破裂的努力失敗,,無法激發(fā)人們對(duì)于中國得天獨(dú)厚、能夠避免災(zāi)難的信心,。

雖然存在這么多切實(shí),、貌似可信的擔(dān)憂,但世界還未遭受一場(chǎng)新的經(jīng)濟(jì)風(fēng)暴的沖擊,。雖然中國受到質(zhì)疑的經(jīng)濟(jì)數(shù)據(jù)仍顯示經(jīng)濟(jì)年增速為7%,,但不可否認(rèn),中國正在從建筑與重機(jī)械業(yè)投資向消費(fèi)和服務(wù)再平衡,。世界其他許多大型經(jīng)濟(jì)體的境況和經(jīng)濟(jì)數(shù)據(jù)也遠(yuǎn)算不上很糟,。

仍為世界最重要經(jīng)濟(jì)體的美國正在考慮啟動(dòng)10年來的首次加息。這反映了美國經(jīng)濟(jì)復(fù)蘇已經(jīng)成熟,,實(shí)現(xiàn)就業(yè)增長的努力也已成功,。美國失業(yè)率已降至歷史正常水平。美聯(lián)儲(chǔ)(fed)主席珍妮特耶倫(Janet Yellen)對(duì)為何決定9月不加息的解釋是全球經(jīng)濟(jì)不確定性增加,。耶倫已明確表示,,她認(rèn)為美國經(jīng)濟(jì)前景強(qiáng)勁,,負(fù)責(zé)確定利率的美國聯(lián)邦公開市場(chǎng)委員會(huì)(FOMC)同僚也持同樣看法,。

“當(dāng)前,包括我自己在內(nèi)的多數(shù)聯(lián)邦公開市場(chǎng)委員會(huì)成員預(yù)計(jì),,達(dá)到(充分就業(yè)和穩(wěn)定通脹的)條件后,,我們可能需要在今年晚些時(shí)候邁出提高聯(lián)邦基金利率的第一步,隨后漸進(jìn)式收緊,,”耶倫9月表示,。

在歐洲,許多經(jīng)濟(jì)指標(biāo)看起來比2011年歐元區(qū)危機(jī)爆發(fā)以來的任何時(shí)候都更加積極,。希臘今年已表現(xiàn)出它不再有能力讓歐元區(qū)其他國家經(jīng)濟(jì)脫軌,,而隨著全球大宗商品價(jià)格下跌,消費(fèi)者正在享受少有的凈收入增加,。

貨幣,、財(cái)政政策隨時(shí)待命,準(zhǔn)備應(yīng)對(duì)全球經(jīng)濟(jì)增長放緩前景,,未來幾個(gè)月還可能出臺(tái)進(jìn)一步貨幣政策刺激,。

作為石油與金屬的大型進(jìn)口國,,中國從大宗商品價(jià)格下跌中獲益,同樣受益的還有印度——世界增長最快的大型經(jīng)濟(jì)體,。許多治理較好的大宗商品出口國受益于貨幣貶值,,在沒有顯著提高通脹率的情況下抵消了降價(jià)對(duì)國內(nèi)造成的沖擊。

凱投宏觀(Capital Economics)分析師朱利安瀠≧湽(Julian Jessop)認(rèn)為,,市場(chǎng)對(duì)今夏事件的震驚反應(yīng)太過突然和過度:“因此,,我們認(rèn)為,主流觀點(diǎn)在追趕已經(jīng)存在多年的趨勢(shì),,而不是說這種動(dòng)蕩是一種新的威脅,。”

如果真是如此,世界是在繼續(xù)以約為過去30年平均水平的速度增長(其中有的國家做得好一些,,有的差一些),,而非正進(jìn)入全球金融危機(jī)的第三階段,換句話說,,是常態(tài),,而非非常時(shí)期。

對(duì)中國而言,,如果這種務(wù)實(shí)的觀點(diǎn)站得住腳的話,,那么中國當(dāng)局在推動(dòng)經(jīng)濟(jì)由投資轉(zhuǎn)向消費(fèi)再平衡的過程中會(huì)犯錯(cuò),但也會(huì)取得進(jìn)展,。

裕信銀行(UniCredit)首席經(jīng)濟(jì)學(xué)家埃里克尼爾森(Erik Nielsen)說,,盡管面臨許多選項(xiàng),但2016年的世界不必選擇一條極端道路,。

“我們經(jīng)濟(jì)學(xué)家喜歡預(yù)測(cè)未來道路是一片坦途,,而一驚一乍者和危言聳聽者喜歡預(yù)測(cè)崩潰即將來臨,”他說,。

“也許保險(xiǎn)的預(yù)測(cè)介于兩者之間:未來道路崎嶇不平,,但情況在合理可控范圍內(nèi)。”(中國進(jìn)出口網(wǎng))

The world economy appears to be at a fork in the road. On one path, 2016 appears likely to witness a deterioration from the mediocre to the miserable; on the other is a happy continuation of the normalisation from the 2008-09 financial crisis, with a more balanced and sustainable global economy. No one is sure which path the world will follow; nor whether policy is sufficiently strong to influence the outcome.

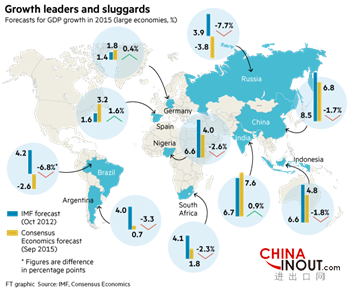

There is little doubt that the eyes of the world are sharply focused on the risks and challenges. Fears rose precipitously in the summer after China devalued its currency, highlighting concerns that the country’s economic prospects are deteriorating rapidly and recessions deepened in other former stars of the global economy such as Brazil and Russia. Global equity markets have just endured their worst quarter since 2011.

Alongside weak financial markets, capital has retreated towards havens in the developed world, commodity prices have plummeted and world trade growth remains stalled. China, not long ago the reliable engine of the world economy, is now seen as its greatest vulnerability, representing, as it does, 16 per cent of world output and almost 30 per cent of expected growth. “The key risk to global growth is a larger-than-expected slowdown in China,” according to the Organisation for Economic Co-operation and Development.

With some investment banks such as Citi forecasting a global recession in 2016, officials are keen not to be caught napping as they were before the 2008 downturn.

Christine Lagarde, head of the IMF, says policies to address problems among the world’s leading economies are urgently needed at a“difficult and complex” time, since “downside risks to the outlook have increased, particularly for emerging market economies”.

Andy Haldane, chief economist of the Bank of England, warns that the troubles in China are signs that “we may now be entering the early stages of part three of the [global crisis] trilogy, the ‘emerging market’ crisis of 2015 onwards”.

A third crisis scenario — following that in the US and UK economies in 2008-09 and the eurozone in 2011-12 — would stem from dangers posed by the rise in Chinese debt since 2008. Private, non-financial debt reached 160 per cent of gross domestic product in the US in 2007 and almost 200 per cent in the UK before households and companies tightened their belts. China has already surpassed these levels, according to data from the Bank for International Settlements.

With growth slowing, perhaps far more rapidly than official Chinese statistics show, the ability to service and sustain such debt is in question. Defaults and huge losses could follow, sparking a vicious circle of fragility and bankruptcy in the financial sector, a squeeze on credit and yet weaker economic prospects. The rest of the world would not be able to ignore such a crisis, given China’s size, trade links and financial connections with other countries.

Beijing’s mixed messages and failed attempts to prevent its stock market bubble bursting over the summer have not inspired confidence that it is uniquely placed to avoid disaster.

But for all these genuine and plausible fears, the world is not yet being buffeted by another economic storm. Despite contested Chinese economic statistics showing growth still at an annual rate of 7 per cent, there is undeniable rebalancing under way in China from construction and heavy machinery investment towards consumption and services. In many of the other large world economies, the picture and the economic data are far from disastrous.

Still the world’s most important economy, the US is contemplating raising interest rates for the first time in a decade. This reflects the maturity of its economic recovery and its success in generating employment growth. The unemployment rate has fallen to historically normal levels. Janet Yellen, Federal Reserve chair, explained the decision not to raise rates in September as reflecting increased uncertainty in the global economy. Ms Yellen has made it clear that she sees strong prospects when she looks at the US, as do her colleagues on the Federal Open Market Committee, which sets interest rates.

“Most FOMC participants, including myself, currently anticipate that achieving these conditions [of maximum employment and stable inflation] will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening,” Ms Yellen said in September.

In Europe, many economic indicators are looking more positive than at any time since the eurozone crisis started in 2011. Greece showed this year that it no longer has the power to derail the rest of the single currency area and consumers are enjoying a rare increase in their net incomes following the decline in commodity prices across the world.

Monetary and fiscal policy is standing by, ready to react to slower global growth prospects, with further monetary stimulus likely in coming months.

As a big oil and metals importer, China gains from the fall in commodity prices, as does India — the world’s fastest growing big economy. Many of the better managed commodity-exporting economies have benefited from currency depreciation, offsetting the domestic hit from lower prices without raising inflation significantly.

Julian Jessop of analysts Capital Economics thinks that the shocked market reaction to the events of the summer has been far too sudden and excessive: “The upshot is that rather than the turmoil being a new threat, we think that the consensus is playing catch-up with trends in place for several years.”

If true, rather than the world entering a third leg of a global financial crisis, it is more a continuation of global growth at roughly the average level of the past 30 years, with some countries doing better than others: normality rather than extraordinary times.

As for China, if this pragmatic view holds true, the authorities will make errors but also progress in rebalancing the economy from investment towards consumption.

The world in 2016 does not need to take an extreme path, says Erik Nielsen, chief economist at UniCredit — though there are many options available.

“We economists love to forecast smooth paths, while drama queens and headline grabbers love to predict imminent collapse,” he says.

“Maybe the safe forecast is one in between the two: bumpy, but reasonably well managed.”