調(diào)查稱亞洲億萬富翁財(cái)富增長最快

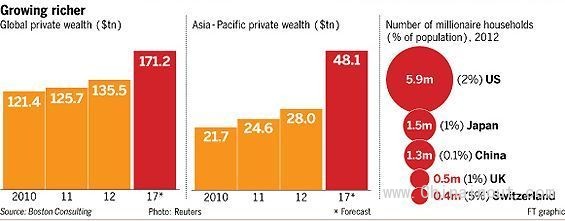

一項(xiàng)年度調(diào)查顯示,過去12個(gè)月,,亞洲億萬富翁創(chuàng)造財(cái)富的速度快于全球任何其他地區(qū),,期間全球億萬富翁財(cái)富總值達(dá)到7.3萬億美元,增長12%,,亞洲貢獻(xiàn)了其中近三分之一的增長,。

調(diào)查稱,億萬富翁控制著全球近4%的財(cái)富,,過去一年新增155位億萬富翁,,這將全球億萬富翁總數(shù)推升至創(chuàng)紀(jì)錄的2325位,較上次調(diào)查增加7%,。

紐約的億萬富翁數(shù)量最多,,為103位,接下來為莫斯科85位,,香港82位,,倫敦72位,北京37位,。

周二,,軟銀(SoftBank)創(chuàng)始人孫正義(Masayoshi Son)取代日本迅銷公司(Fast Retailing)創(chuàng)始人柳井正(Tadashi Yanai),,成為日本首富,這得益于即將啟動(dòng)的阿里巴巴(Alibaba)首次公開發(fā)行(IPO),。孫正義的個(gè)人財(cái)富達(dá)到166億美元,。

歐洲億萬富翁數(shù)量(775位)及其財(cái)富總額(2.37萬億美元)均為全球之冠。亞洲億萬富翁的財(cái)富增速為全球最快,,在調(diào)查期間財(cái)富增加18.7%,,而全球平均增幅為11.9%。

在截至今年7月的12個(gè)月里,,亞洲億萬富翁數(shù)量增加10%,,有52位新富豪加入這個(gè)行列,其中33位來自中國內(nèi)地,。

在今年的調(diào)查中,,億萬富翁財(cái)富總額曾在2013年奪冠的北美被歐洲取代。

美國仍是全球億萬富翁數(shù)量最多的國家,,共有571位億萬富翁,,接下來是中國內(nèi)地(190位)和英國(130位),德國(123位)位居第四,,將去年的第三位讓與英國,。

Wealth-X和瑞銀表示,“財(cái)富從嬰兒潮時(shí)代出生的人們向他們的繼承者轉(zhuǎn)移的巨大浪潮”正在出現(xiàn),,結(jié)果是,,部分財(cái)富為繼承而來的億萬富翁數(shù)量增加最快。

Wealth-X和瑞銀表示:“然而,,全球億萬富翁的共同特點(diǎn)之一是他們的創(chuàng)業(yè)精神,。在多數(shù)情況下,取得億萬富翁地位不僅僅需要繼承財(cái)富:81%的億萬富翁是靠自己的努力賺取大部分財(cái)富的,。”

調(diào)查期間,,每位億萬富翁將持有的現(xiàn)金及現(xiàn)金等價(jià)物(例如股票或債券)從上次調(diào)查的平均5.40億美元增加至6億美元。

這兩個(gè)數(shù)字均占各自調(diào)查期間億萬富翁平均資產(chǎn)凈值的19%,,現(xiàn)金資產(chǎn)價(jià)值增速加快的原因是本次調(diào)查期間總財(cái)富增長,。

Wealth-X和瑞銀表示,億萬富翁持有現(xiàn)金的規(guī)模表明,,很多人“正等待最佳時(shí)機(jī)繼續(xù)投資”,。(更多資訊請關(guān)注中國進(jìn)出口網(wǎng))

Asian billionaires create wealth fastest

Wealth was created faster by Asia’s billionaires than by those in any other part of the globe in the past 12 months, with the region accounting for almost a third of a 12 per cent increase in global billionaire wealth of $7.3tn, according to an annual survey.

The combined wealth of the world’s billionaires is now higher than the combined market capitalisation of all the companies that make up the Dow Jones Industrial Average, according to the survey, conducted between June last year and July by Wealth-X, a research firm, and UBS, the Swiss-based bank.

Billionaires control nearly 4 per cent of the world’s wealth, the survey claims, with 155 new billionaires minted in the past year, pushing the global population to a record 2,325 – a 7 per cent rise from the last period surveyed.

New York hosts the biggest number – 103 – with Moscow (85), Hong Kong (82), London (72) and Beijing (37) taking the next four spots.

On Tuesday, SoftBank founder Masayoshi Son overtook Tadashi Yanai, founder of Fast Retailing, to become Japan’s richest man, boosted by the forthcoming Alibaba initial public offering. Mr Son has a personal fortune of $16.6bn.

Europe, with 775 billionaires, was the region with the most billionaires and billionaire wealth ($2.37tn). Asia boasted the largest billionaire wealth increase, with fortunes growing by 18.7 per cent over the period surveyed, compared with a global average rate of 11.9 per cent.

Asia’s billionaire population grew 10 per cent in the 12 months to July, with 52 new entrants into the billionaire club – of whom 33 were from China.

North America – the region with the most billionaire wealth in 2013 – was overtaken by Europe in terms of wealth in this year’s census.

The US maintained its position as the world’s top billionaire country with a population of 571 billionaires, followed by China (190) and the UK (130), which took third spot from Germany (123).

Wealth-X and UBS said a “massive wave of intergenerational wealth transfer from baby boomers to their heirs” was under way, with the result that billionaires with partially inherited wealth were the fastest-growing segment of this population.

“Yet, one of the common characteristics of the world’s billionaires is their entrepreneurialism. In most instances, achieving billionaire status requires more than merely inheritance: 81 per cent of billionaires made the majority of their fortunes themselves,” the two said.

Billionaires increased their holdings of cash and cash equivalents such as shares or bonds in the period to an average of $600m each from $540m last time.

Both amounts were the equivalent of 19 per cent of average net worth, with the increase in value of cash holdings rising because total wealth increased in the period.

Wealth-X and UBS said the level of cash held signalled that many are “waiting for the optimal time to make further investments”.

(更多資訊請關(guān)注中國進(jìn)出口網(wǎng))