西方汽車制造商在中國正面臨進(jìn)口自美國的它們自己所產(chǎn)的汽車的競爭,,“平行進(jìn)口”在全球最大汽車市場帶來新的挑戰(zhàn),。

成立不久的上海自貿(mào)區(qū)上周公布新的規(guī)定,正式使在華銷售制造商原本打算在美國及其他市場售賣的汽車合法化,,使買家可以享受約20%的折扣,。

去年,,中國競爭監(jiān)管機(jī)構(gòu)在針對涉嫌壟斷行為的調(diào)查中,迫使許多外國汽車制造商降低汽車,、零配件和服務(wù)成本,。中國汽車經(jīng)銷商也要求供應(yīng)商給予更多財(cái)務(wù)上的支持。

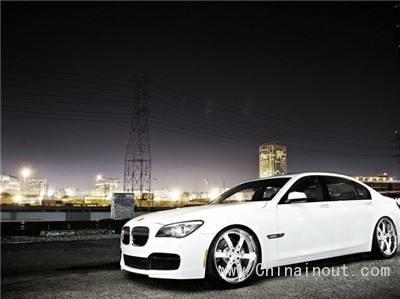

現(xiàn)在,,平行進(jìn)口市場的出現(xiàn)正為跨國汽車制造商帶來更大的價(jià)格壓力,,尤其是高端的歐洲品牌。

通過制造商在美國和中國的官方經(jīng)銷商網(wǎng)絡(luò)銷售的同一品牌的汽車的售價(jià)差別巨大,,在太平洋兩岸之間制造了一個(gè)套利機(jī)會,。越來越多的中間商在美國購買汽車,然后將其發(fā)運(yùn)至未經(jīng)授權(quán)的中國經(jīng)銷商,。

在中國最大的平行進(jìn)口汽車市場——港口城市天津,,一輛從美國進(jìn)口的奧迪(Audi) Q7運(yùn)動型多功能車(SUV)上周的售價(jià)是66萬元人民幣(合10.6萬美元),比這家德國制造商授權(quán)的中國經(jīng)銷商82.8萬元人民幣的售價(jià)便宜20%,。在美國,,奧迪Q7的建議零售價(jià)起步僅為4.83萬美元,即29.9萬元人民幣,。

汽車制造商正在他們最大,、利潤最豐厚的市場回?fù)暨@個(gè)最新威脅,禁止各自的美國經(jīng)銷商把車賣給那些他們懷疑打算向中國出口汽車的人,。但是如果套利者在美國購得一輛汽車,,他們將車運(yùn)往國外是合法的。

伯恩斯坦研究公司(Bernstein Research)分析師馬克斯•沃伯頓(Max Warburton)說:“(制造商)在中國已敗下陣來,。在美國,,他們正想盡一切辦法來應(yīng)對,。”(中國進(jìn)出口網(wǎng))

Western carmakers are facing competition in China from the sale of their own imported vehicles from the US, as “parallel imports” provide a new challenge in the world’s largest auto market.

New rules from Shanghai’s fledgling free trade zone, issued last week, formally legalise the sale of cars that manufacturers originally intended to sell in the US and other markets — allowing buyers to receive discounts of about 20 per cent.

Last year, Chinese competition regulators forced many foreign carmakers to lower the cost of their vehicles, spare parts and services during a probe of allegedly anti-competitive behaviour. Chinese car dealers have also demanded greater financial support from their suppliers.

Now the emergence of parallel import markets is putting even greater price pressure on multinational carmakers, especially premium European brands.

Large price differentials for brands sold via manufacturers’ official dealer networks in the US and China create an arbitrage opportunity across the Pacific. Middlemen are buying cars in the US and shipping them to unauthorised dealers in China in increasing numbers.

At China’s largest market for parallel imports, in the port city of Tianjin, an Audi Q7 sport utility vehicle imported from the US was on sale last week for Rmb660,000 ($106,000) — 20 per cent cheaper than the Rmb828,000 charged by the German manufacturer’s authorised China dealerships. In the US, Audi’s suggested retail prices for the Q7 start at just $48,300, or Rmb299,000.

Carmakers are fighting back against this latest threat to their largest and most profitable market, prohibiting their US dealers from selling cars to people who they suspect intend to export the vehicles to China. But once arbitrageurs have obtained a car in the US, it is legal for them to ship it abroad.

“The [carmakers] have lost the battle on the Chinese side,” said Max Warburton, an analyst at Bernstein Research. “On the US side they are throwing everything they can think of at it.”