沒(méi)有幾種經(jīng)濟(jì)要素比大宗商品價(jià)格更重要,。當(dāng)大宗商品價(jià)格上漲時(shí),,它會(huì)將財(cái)富和實(shí)力從消費(fèi)者轉(zhuǎn)移到生產(chǎn)者;當(dāng)價(jià)格下跌時(shí),,對(duì)于消費(fèi)者而言,,這幾乎像是經(jīng)濟(jì)學(xué)里的免費(fèi)午餐。大宗商品價(jià)格關(guān)系重大,,其轉(zhuǎn)折點(diǎn)對(duì)于全球經(jīng)濟(jì)很重要,。眼前似乎就將迎來(lái)這樣一個(gè)時(shí)刻。

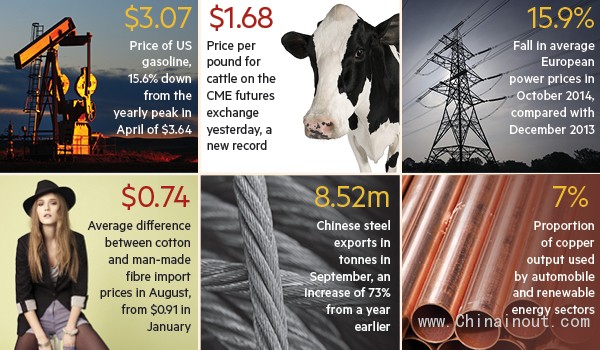

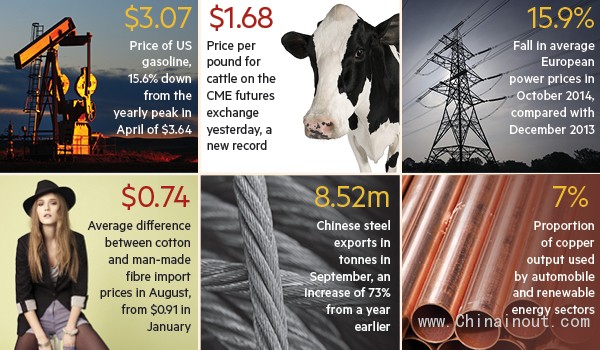

多種大宗商品價(jià)格都在下跌,,有時(shí)是快速下跌,。彭博(Bloomberg)大宗商品指數(shù)(大宗商品投資的一個(gè)基準(zhǔn))近期降至5年最低水平。多數(shù)大宗商品供應(yīng)不斷增加以及全球經(jīng)濟(jì)(包括中國(guó)經(jīng)濟(jì))日益放緩正推低大宗商品價(jià)格,。中國(guó)是很多大宗商品的最大消費(fèi)國(guó),。不管是石油、玉米,、鐵礦石,、煤炭、棉花還是銅,,價(jià)格都在快速下跌,。

國(guó)際貨幣基金組織(IMF)估計(jì),全球大宗商品價(jià)格較今年年初下滑8.3%,。在最近公布的《世界經(jīng)濟(jì)展望》(World Economic Outlook)報(bào)告中,,IMF稱,石油價(jià)格每桶下跌20美元將增加消費(fèi)者的實(shí)際收入,、提振消費(fèi)國(guó)的國(guó)內(nèi)需求和經(jīng)濟(jì)增速,,同時(shí)沖擊產(chǎn)油國(guó)的出口和需求。IMF估計(jì),,其凈效應(yīng)將是令全球GDP擴(kuò)大0.5%,,如果經(jīng)濟(jì)信心因此改善,這一數(shù)字可能會(huì)升至1.2%左右。Fulcrum資產(chǎn)管理公司董事長(zhǎng)加文•戴維斯(Gavyn Davies)表示,,這些估計(jì)數(shù)字是合理的,,而且以任何標(biāo)準(zhǔn)衡量都”很大“。

根據(jù)凱投宏觀(Capital Economics)經(jīng)濟(jì)學(xué)家安德魯•肯寧厄姆(Andrew Kenningham)的計(jì)算,,同樣的變動(dòng)將把6400億美元財(cái)富(占全球GDP的近1%)從產(chǎn)油國(guó)轉(zhuǎn)移到消費(fèi)國(guó),。他表示:“我們的經(jīng)驗(yàn)是,消費(fèi)者一般會(huì)將意外收獲的一半用于支出,。那就是3200億美元,約占全球GDP的0.5%,。”

由于其他大宗商品價(jià)格會(huì)隨著油價(jià)一起下跌,,預(yù)計(jì)這種效應(yīng)將放大,令全球增長(zhǎng)受益,,但在創(chuàng)造贏家的同時(shí)也會(huì)產(chǎn)生輸家,。增長(zhǎng)預(yù)期所受的影響最為明顯。2011年,,當(dāng)時(shí)市場(chǎng)預(yù)計(jì)大宗商品價(jià)格將長(zhǎng)期處于高位,,IMF預(yù)測(cè),2014年巴西經(jīng)濟(jì)將增長(zhǎng)逾4%,,并且中期內(nèi)將能夠保持這一增速,。如今,IMF預(yù)測(cè),,今年巴西經(jīng)濟(jì)將接近滯漲,,中期增速將緩慢升至3%的水平。俄羅斯也是同樣的命運(yùn),,況且該國(guó)還要應(yīng)對(duì)西方制裁的沖擊,。

然而,一些影響可能是復(fù)雜的,。除了在不同國(guó)家之間出現(xiàn)資金再分配之外,,同一國(guó)家中也會(huì)有贏家和輸家。對(duì)于美國(guó)的駕車者而言,,油價(jià)不斷下跌的影響就像是減稅,,但這會(huì)沖擊該國(guó)的頁(yè)巖油行業(yè)。2011年,,食品價(jià)格飆升對(duì)巴西農(nóng)業(yè)是一種利好,,但對(duì)于該國(guó)城市窮人而言卻是一項(xiàng)沉重的負(fù)擔(dān)。

匯率變動(dòng)可能會(huì)令情況復(fù)雜化,,因?yàn)槎鄶?shù)大宗商品都是以美元計(jì)價(jià),。亞洲一些地區(qū)的貨幣兌美元匯率正在下跌。因此,高盛(Goldman Sachs)大宗商品研究主管杰夫•居里(Jeff Currie)表示,,印度消費(fèi)者沒(méi)有看到巨大的好處,,因?yàn)橐杂《缺R比計(jì)算油價(jià)沒(méi)有快速下跌,而在印尼等國(guó),,因應(yīng)燃料價(jià)格下跌,,政府也削減了燃料補(bǔ)貼,因此,,消費(fèi)者也沒(méi)有看到完全的好處,。在計(jì)入?yún)R率和稅收變動(dòng)后,居里表示,,美國(guó)是唯一一個(gè)消費(fèi)者可能會(huì)看到巨大好處的國(guó)家,。

作為一個(gè)消費(fèi)和進(jìn)口大戶,歐元區(qū)將受益于大宗商品價(jià)格下跌,,但經(jīng)濟(jì)學(xué)家警告稱,,歐洲不能高興過(guò)了頭。大宗商品價(jià)格持續(xù)下跌可能會(huì)令歐元區(qū)陷入徹底的通縮,,這可能會(huì)促使消費(fèi)者推遲購(gòu)買行為,,因?yàn)槿藗冾A(yù)測(cè)未來(lái)價(jià)格會(huì)繼續(xù)下跌。

這都是理論,,但可能會(huì)破壞歐洲央行(ECB)將中期通脹預(yù)期穩(wěn)定在每年約2%的努力,。巴克萊(Barclays)的托馬斯•哈吉斯(Thomas Harjes)表示:“基于市場(chǎng)的通脹預(yù)期指標(biāo)越來(lái)越顯示,歐洲央行有喪失公信力的風(fēng)險(xiǎn),,市場(chǎng)可能認(rèn)為其無(wú)法將通脹恢復(fù)到接近2%的目標(biāo)水平,,即便是在中期內(nèi)。” (

中國(guó)進(jìn)出口網(wǎng))

Few economic forces are more important than commodity prices. When they rise they transfer riches and power from consumers to producers; when they fall, it is as near as anything in economics to a free lunch for consumers. With so much at stake, turning points are important for the global economy. Such a moment appears to be at hand.

Across a wide range of commodities, prices are falling and sometimes falling fast. The Bloomberg commodity index – which acts as a benchmark for commodity investments – fell to its lowest level in five years this week. Prices are being pushed down by the increasing supply of most commodities and a weakening global economy, including a slowing China, the world’s largest consumer for many of these raw materials. Whether it is oil, corn, iron ore, coal, cotton or copper, prices are falling quickly.

The International Monetary Fund estimates that global commodity prices are 8.3 per cent lower than at the start of the year. In its recent World Economic Outlook report, the IMF demonstrated how a $20-a-barrel oil price decline would increase the real income of consumers, boosting domestic demand and growth in consuming countries and hitting exports and demand in producer nations. The fund estimated the net effect would increase world gross domestic product 0.5 per cent alone, and if economic confidence were improved as a result, that figure could rise to about 1.2 per cent. Gavyn Davies, chairman of Fulcrum Asset Management, says the figures were plausible and by any measure “quite big”.

Andrew Kenningham, economist at Capital Economics, has calculated that an equivalent change would transfer $640bn – or nearly 1 per cent of world GDP – from oil producers to consumers. “Our rule of thumb is that consumers typically spend half of their windfall. This is $320bn or around 0.5 per cent of world GDP, ” he says.

With other commodity prices falling alongside oil, the effects can be expected to amplify, benefiting global growth but also creating losers as well as winners. The effects are most obvious in growth forecasts. In 2011, when commodity prices were expected to remain persistently high, the IMF forecast Brazil’s economy would expand more than 4 per cent in 2014, a rate it would be able to sustain into the medium term. Now it is expecting near stagnation this year with a slow climb towards a 3 per cent medium-term rate. Russia, which also has to deal with the added impact of western sanctions, shares the same fate.

Some effects can be complicated, however. As well as redistributing money between countries, there are also winners and losers within the same nation. While falling oil prices act as a tax cut for US motorists, it hits the country’s shale oil industry. In 2011, the surge in food prices was a boon to Brazilian agriculture but a huge burden on its urban poor.

Exchange rate movements can complicate the picture, since most commodities are priced in dollars. In parts of Asia currencies are falling relative to the dollar. As a result says Jeff Currie, head of commodities research at Goldman Sachs, consumers in India are not seeing big gains because oil prices in rupees are not falling fast, and in countries such as Indonesia, the government is offsetting lower fuel prices with cuts in fuel subsidies so, again, consumers have not seen the full benefit. After taking account of currency and tax changes, Mr Currie says the US is the only country in which consumers are likely to see a big benefit.

As a big consumer and importer, the eurozone will benefit from the turndown in commodity prices, but economists warn Europe must avoid getting too much of this good thing. Falling commodity prices could tip the eurozone into outright deflation, potentially delaying consumer purchases on the expectation of even lower future prices.

This is all theoretical, but could undermine efforts by the European Central Bank to stabilise medium-term expectation of inflation to about 2 per cent a year. Thomas Harjes of Barclays says: “Market-based measures of inflation expectations are increasingly indicating that the ECB is at risk of losing its credibility to return inflation back to the close-to-2 per cent target, even over the medium term.”