美國經(jīng)濟(jì)增長,美聯(lián)儲仍持謹(jǐn)慎態(tài)度

2014年從華盛頓報(bào)道,7月31日12:03等

馬丁·CRUTSINGER美聯(lián)社經(jīng)濟(jì)學(xué)作家

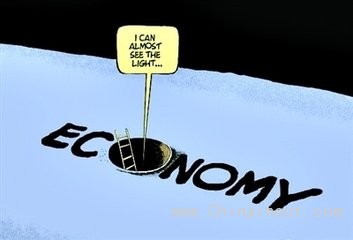

美國經(jīng)濟(jì)2014年有一個嚴(yán)峻的開始,現(xiàn)在顯現(xiàn)了經(jīng)濟(jì)強(qiáng)勢反彈的勢頭,,這種復(fù)蘇勢頭將持續(xù)到明年,。

分析師根據(jù)周三政府4 - 6月季度的增長率為4%的統(tǒng)計(jì)數(shù)據(jù)所得出的整體觀點(diǎn)。消費(fèi)者,、企業(yè)和政府相結(jié)合為經(jīng)濟(jì)復(fù)蘇注入了活力,。政府還表示,相比去年經(jīng)濟(jì)增長要比之前估計(jì)的更強(qiáng)勢。

經(jīng)濟(jì)更良性增長是否將導(dǎo)致美國聯(lián)邦儲備理事會(美聯(lián)儲,fed)比預(yù)期的更早升息尚不清楚,。周三美聯(lián)儲對經(jīng)濟(jì)提供了一個復(fù)雜的信息:增長正在加強(qiáng),失業(yè)率穩(wěn)步下降,。它提到但從某種程度上就業(yè)市場仍然欠佳.

美聯(lián)儲為期兩天的政策會議后發(fā)表的一份聲明中表示在開始提高其關(guān)鍵的短期利率之前,它希望看到經(jīng)濟(jì)的進(jìn)一步改善。但并沒有提及具體什么時候提高利率,。

相反,美聯(lián)儲重申計(jì)劃“結(jié)束后其月度購買債券后,,會在相當(dāng)一段時間保持低短期利率。美聯(lián)儲表示,將放緩一個月100億到250億美元債券購買速度,。購買,旨在讓長期借款利率保持低水平,在10月將結(jié)束,。大多數(shù)經(jīng)濟(jì)學(xué)家認(rèn)為一年左右可能加息。

經(jīng)歷了一個年2.1%增速,,經(jīng)濟(jì)急劇萎縮的發(fā)展期,,自上一季度經(jīng)濟(jì)突然反彈。政府提高了之前下降2.9%的估計(jì),。但它仍然是2009年初大蕭條最嚴(yán)重的時候以來最大收縮在,。

上一季度的反彈驗(yàn)證了分析師的觀點(diǎn),即經(jīng)濟(jì)的勢頭延續(xù)到今年下半年,他們預(yù)測經(jīng)濟(jì)年增長率約為3%。

As US Economy Accelerates, Fed Remains Cautious

WASHINGTON — Jul 31, 2014, 12:03 AM ET

By MARTIN CRUTSINGER AP Economics Writer

After a grim start to 2014, the U.S. economy has rebounded with vigor and should show renewed strength into next year.

That was the general view of analysts Wednesday after the government estimated that the economy grew at a fast 4 percent annual rate in the April-June quarter. Consumers, businesses and governments combined to fuel the expansion. The government also said growth was more robust last year than previously estimated.

Whether the healthier expansion will lead the Federal Reserve to raise interest rates sooner than expected is unclear. The Fed offered a mixed message on the economy Wednesday: Growth is strengthening, and the unemployment rate is steadily falling. Yet by some measures, it suggested, the job market remains subpar.

,。

A statement the Fed issued after a two-day policy meeting signaled that it wants to see further improvement before it starts raising its key short-term interest rate. It offered no clearer hint of when it will raise that rate.

Instead, the Fed reiterated its plan to keep short-term rates low "for a considerable time" after ends its monthly bond purchases. The Fed said it will slow the pace of its purchases by another $10 billion to $25 billion a month. The purchases, which have been intended to keep long-term borrowing rates low, are set to end in October. Most economists think a rate increase is about a year away.

The economy sprang back to life last quarter after a dismal winter in which it shrank at a sharp 2.1 percent annual rate. The government upgraded that decline from a previous estimate of a 2.9 percent drop. But it was still the biggest contraction since early 2009 in the depths of the Great Recession.

Last quarter's bounce-back reinforced analysts' view that the economy's momentum is extending into the second half of the year, when they forecast annual growth of around 3 percent.